Digital media is trouncing traditional channels among up-and-coming Millennials: 81% of affluent Gen-Y adults use Facebook every day—roughly double the number who read newspaper content (45%) or watch TV (44%) daily, according to a new study by L2. Moreover, 45% of such consumers read at least one blog every day.

Gen-Y affluents are 27 years old on average, and they are on a path to earn over $100,000 annually in the short term, and double that income within the next five years, according to the study.

Facebook is fundamental among Gen-Y affluents:

- Over one-half say their attitudes about brands are shaped by Facebook.

- 54% have "liked" a brand on Facebook in the previous month.

- 38% have posted a comment in the previous month.

- 30% have "shared" brands with their networks in the previous month.

Below, other findings from the L2 study titled Gen Y Affluents, based on a survey of 535 young adults.

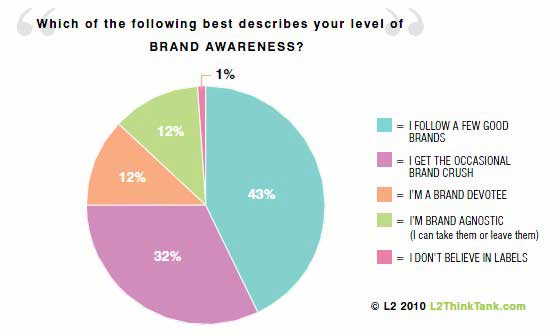

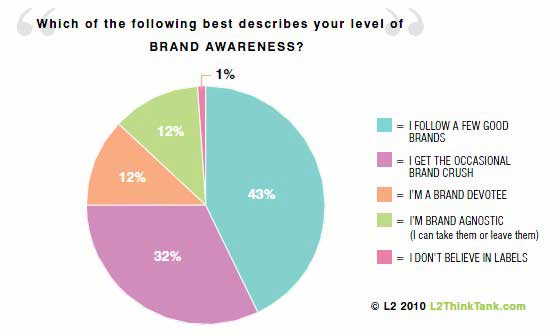

Gen-Y affluents are both brand aware and eager to interact: Three-quarters have some affinity for brands, either "following a few good brands" (43%) or getting the "occasional brand crush" (32%); another 12% are self-proclaimed brand "devotees."

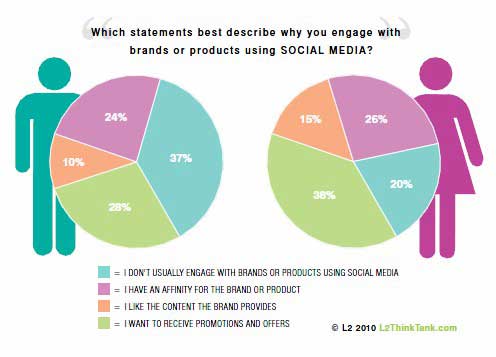

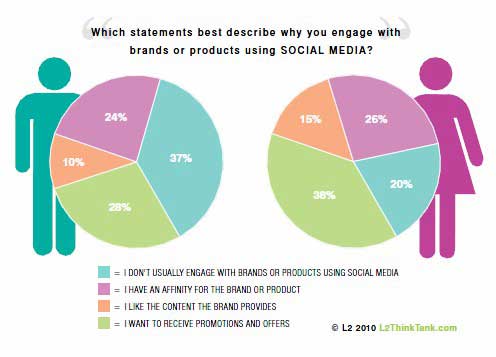

Connecting With Brands via Social Media

Women are more likely than men to engage with brands via social media: 80% of female Gen-Y affluents do so, compared with 63% of male Gen-Y affluents. Women are also more likely than men to connect with brands for special offers (38% vs. 28%) and cite brand content as a reason for engaging (15% vs. 10%).

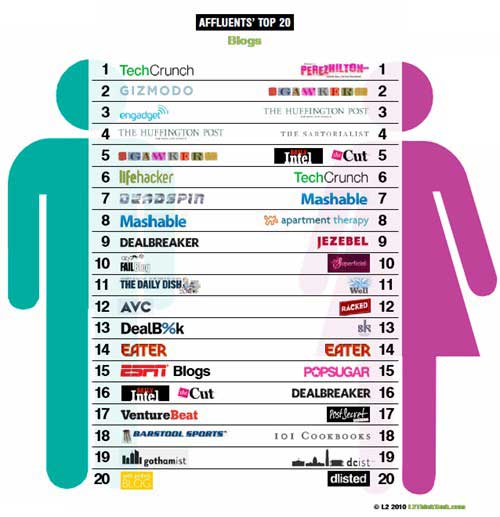

The Blog Generation

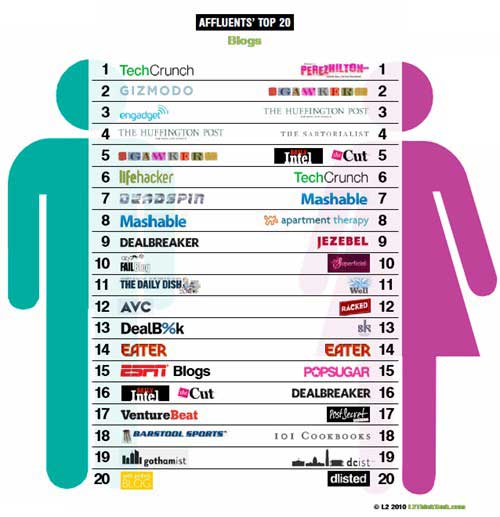

Blogs are as popular as newspapers among Gen-Y affluents. Overall, blogs associated with traditional media organizations such as The New York Times and ESPN equally as popular as those focused on a niche interests:

- Female Gen-Y favorites include Perez Hilton, Gawker, The Huffington Post, The Sartorialist, Daily Intel, and the Cut.

- Male Gen-Y favorites include TechCrunch, Gizmodo, Engadget, The Huffington Post, and Gawker.

Microblogging is even more is also pervasive: Two-thirds of Gen-Y affluents use Twitter, with one in four checking their account in the previous 24 hours.

Looking for real, hard data that can help you match social media tools and tactics to your marketing goals? The State of Social Media Marketing, a 240-page original research report from MarketingProfs, gives you the inside scoop on how 5,140 marketing pros are using social media to create winning campaigns, measure ROI, and reach audiences in new and exciting ways.

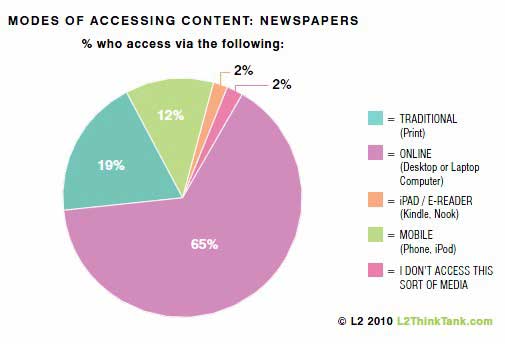

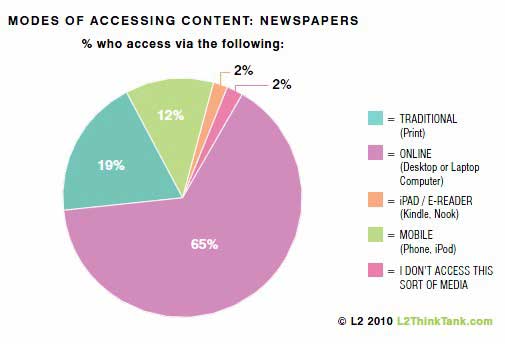

Newspaper and Magazine Content

Some 66% of Gen-Y affluents consume newspaper content online via desktop or laptop computer. Only 19% still read a traditional print newspaper and 12% access news content via their smartphone/iPod.

When reading magazines, however, 71% of Gen-Y affluents read print, and 24% read digital magazine content via desktop or laptop computer. Fewer Gen-Y affluents access magazine content via smartphone/iPod (2%) or e-reader/iPad (2%).

Daily online video viewing is commonplace among Gen-Y affluents:

- 56% say they viewed a video via YouTube in the previous 24 hours.

- 19% viewed a video via Hulu.

- 21% watched video online—other than on YouTube or Hulu.

- 13% used a mobile device to watch a video.

In addition, 42% of Gen-Y affluents watch TV shows online and 27% watch movies online.

Other key mobile-related findings:

- 25% of Gen-Y affluents use their mobile phone to access social media sites.

- Roughly one-third of Gen-Y affluents own a BlackBerry and slightly more own an iPhone; 71% expect to own aniPhone in the future.

- Favorite mobile apps: The top 5 apps among female Gen-Y affluents are Facebook, Maps, Pandora, The Weather Channel, and The New York Times. The top 5 apps among men are Facebook, Maps, Pandora, Angry Birds, and Twitter.

- Apple is the top Prestige Brand among both male and female Gen-Y affluents.

About the data: Findings are based on a October 2010 survey of nearly 1,000 high-achieving and high-earning Gen-Y adults, refined to a panel of 535, age 27 on average. Overall, the sample set is on a trajectory to earn more than $100,000 in the short-term and double that income within the next five years; 75% expect to earn more than $80,000 in the next 24 months.

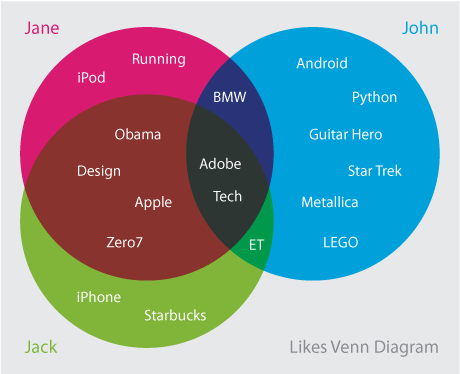

One of the most important things in human relationships is shared values. If two people from totally different cultures meet initially they are weary of each other. They don't know what to expect from each other, they don't know what each others intentions and objectives are. But as soon as they find a common interest, a common value they will start forming a relationship, later an alliance, even friendship. Occasionally when values overlap significantly and objectives can be aligned suddenly a magical thing love happens too.

One of the most important things in human relationships is shared values. If two people from totally different cultures meet initially they are weary of each other. They don't know what to expect from each other, they don't know what each others intentions and objectives are. But as soon as they find a common interest, a common value they will start forming a relationship, later an alliance, even friendship. Occasionally when values overlap significantly and objectives can be aligned suddenly a magical thing love happens too.